st louis county personal property tax office

Per Missouri Revised Statute 137122 property is placed in service when it is ready and available for a specific use whether in a business activity an income-producing activity a tax-exempt activity or a personal activity. Tax AssessorCollector Satellite Office 18335 Highway 603 Kiln MS 39556 228 255-8746 228 255-8747.

Collector Of Revenue St Louis County Website

Who said he was able to move some of his personal items upstairs before water flooded his bedroom in the basement on Tuesday July 26 2022 of his familys.

. W Room 214 Duluth MN 55802-1293 Pay your taxes. GIS Mapping 228 467-0130. The median property tax in Mohave County Arizona is 916 per year for a home worth the median value of 170600.

Arizona is ranked 1632nd of the 3143 counties in the United States in order of the median amount of property taxes collected. Louis County 844-772-4724 Birch Tree Center 218-623-1800. LOUIS The flooding that struck the St.

Louis MS 39521-2428. Tax Liens by the Numbers. Pay Your Personal Property Tax Personal property taxes are due by December 31st of each year.

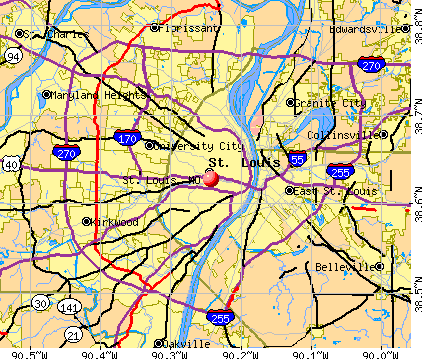

Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property. Louis County is located in the eastern-central portion of MissouriIt is bounded by the City of St. The median property tax in St.

The County Land Explorer allows interested persons to access information on properties within the county by searching using the property address or tax PIN. If you need a notary on a regular basis it might be worth having your own or becoming one yourself. Louis personal property tax history print a tax receipt andor proceed to payment.

By law every parcel in the county must be viewed by an assessor at least once every five years. Mail payment and Property Tax Statement coupon to. Its county seat is Clayton.

Louis County Missouri is 2238 per year for a home worth the median value of 179300. The typical homeowner in St. Individual Personal Property Declarations are mailed in January.

Tax AssessorCollector Annex Office 854 Highway 90 Suite C Bay St. The median property tax in St. As of the 2020 Census the total population was 1004125 making it the most populous county in Missouri.

Thats also more than 1000 higher than the state average. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a. Louis County has one of the highest median property taxes in the United States and is ranked 348th of the 3143 counties in order of median property taxes.

Louis s eɪ n t ˈ l uː ɪ s s ə n t ˈ l uː ɪ s is the second-largest city in MissouriIt sits near the confluence of the Mississippi and the Missouri RiversIn 2020 the city proper had a population of 301578 while the bi-state metropolitan area which extends into Illinois had an estimated population of over 28 million making it the largest metropolitan area in Missouri. The exact property tax levied depends on the county in Texas the property is located in. Obtain a Personal Property Tax Receipt Instructions for how to find City of St.

Louis Missouri determines the value of all taxable property in St. Youre not allowed to notarize your own signature but you can pay for someone elses notary. Duluth Area Crisis Resources Brochure.

The St Louis County Assessors Office located in St. First lets address growing property tax values. Jefferson County Property Records are real estate documents that contain information related to real property in Jefferson County Missouri.

Declare Your Personal Property Declare your personal property online by mail or in person by April 1st. King County collects the highest property tax in Texas levying an average of 156 of median home value yearly in property taxes while Terrell County has the. Hancock County Tax Assessor Post Office Box 2428 Bay St.

Clair County collects on average 187 of a propertys assessed fair market value as property tax. You might also find a notary at a local police or sheriffs office or at city or county offices. Louis area from July 25 to 28 has officially been approved as a major disaster giving flooding victims access to federal funds to help with damage.

Louis County Executive Sam Page. This eastern Missouri county has among the lowest property tax rates of any county in the St. Crisis Text Line Text MN to741741.

Mohave County collects on average 054 of a propertys assessed fair market value as property tax. Louis MS 39520 228 467-4425. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

Real Property Appraisal 228. In King County Washington property values increased 9 from 2021 to 2022. Clair County Illinois is 2291 per year for a home worth the median value of 122400.

Even if the property is not being used the property is in service when it is ready and available for its specific use. To do this the Department estimates a propertys market value and classifies it according to its use for property tax purposes. Louis County governmental offices.

City county or state offices. Additional methods of paying property taxes can be found at. Louis County Auditor 100 N.

All City of St. The county is included in the St. May 15th - 1st Half Agricultural Property Taxes are due.

November 15th - 2nd Half Agricultural Property Taxes are due. The assessment is made as of January 1 for the current years tax and is predicated on 33 13 of true value. Louis and the Mississippi River to the east the Missouri River to the north and the Meramec River to the south.

Louis taxpayers with tangible property are mandated by State law to file a list of all taxable tangible personal property by April 1st of each year with the Assessors Office. Texas is ranked 12th of the 50 states for property taxes as a percentage of median income. It is the Assessors responsibility to ensure each property is equally and uniformly assessed.

Occasionally Clayton city staff receives requests for information that should be directed to St. Louis County governmental offices handle items such as marriage licenses birth or death certificates property tax and matters related to the county jailjustice center and family court. Charles County pays 2624 annually in property taxes the third-highest amount of any county in Missouri.

The City of Clayton. Louis County collects on average 125 of a propertys assessed fair market value as property tax. Clair County has one of the highest median property taxes in the United States and is ranked 328th of the 3143 counties in order of median property taxes.

Louis County Assessors Office maintains an online property information page through the different tools available. County Land Explorer Property Details Search and Assessment Maps. Louis County 844-772-4724.

Louis Property Records are real estate documents that contain information related to real property in St.

St Louis County Mo Stlcounty Twitter

10 Best St Louis Suburbs Trendy Suburb Of St Louis Mo Map 2022

15 Portland Pl Saint Louis Mo 63108 Mansions Lake House Architecture

Print Tax Receipts St Louis County Website

Opinion How Municipalities In St Louis County Mo Profit From Poverty The Washington Post

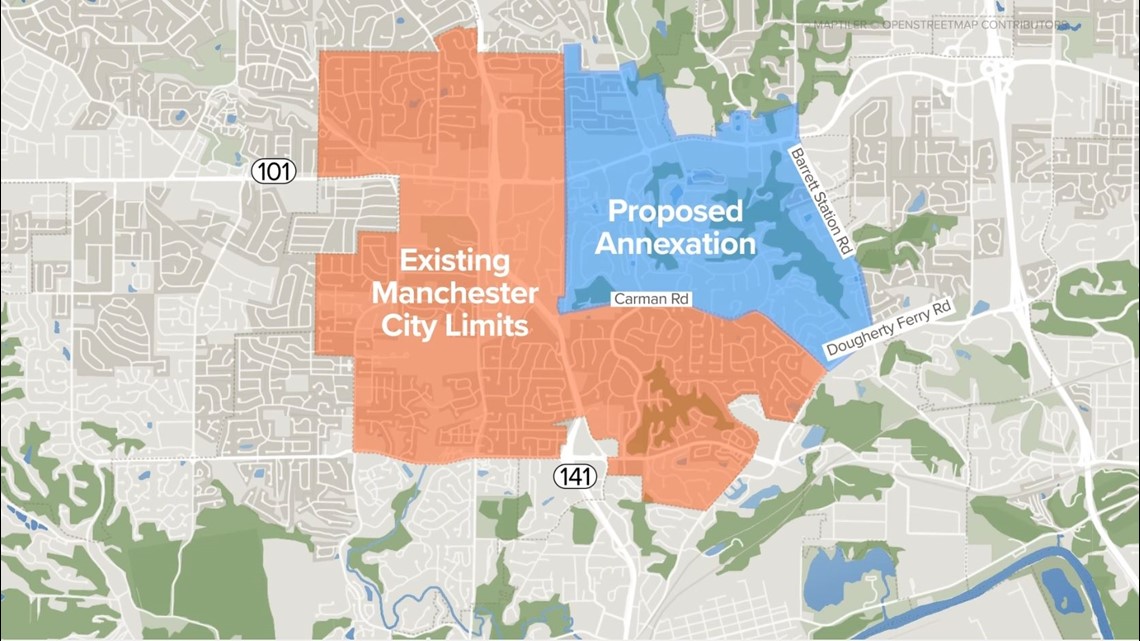

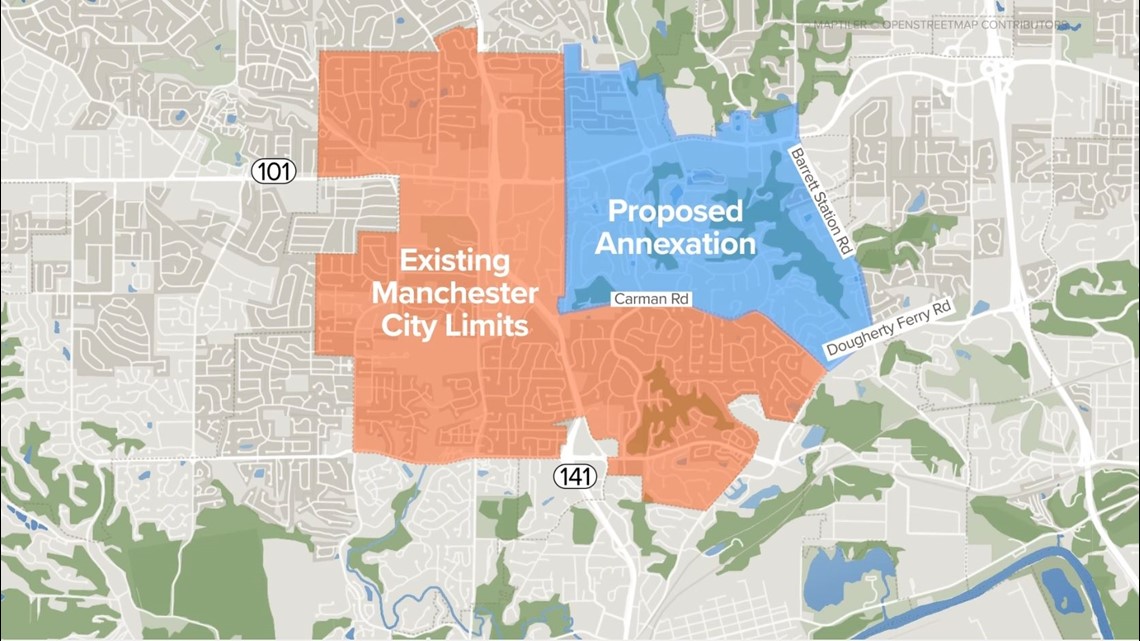

Manchester Seeks To Annex Unincorporated St Louis County Ksdk Com

St Louis County Land Sale Home Facebook

St Louis County Post Third Tax Sale List Youtube

St Louis County S Embattled Tax Collector Resigns St Louis County Resignation Louis

Notice Of Eviction Real Estate Forms Real Estate Forms Business Proposal Sample Free Basic Templates

Action Plan For Walking And Biking St Louis County Website

Collector Of Revenue St Louis County Website

Revenue St Louis County Website

Online Payments And Forms St Louis County Website

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

St Louis County Fta Fees 825k Class Action Settlement Top Class Actions